SINGLE AND MULTIVARIABLE CALCULUS APPLICATIONS FOR FISCAL REDISTRIBUTION

Zach R Facey • 2025-01-01

𝙄𝙣𝙨𝙩𝙞𝙩𝙪𝙩𝙚 - 𝙀𝙘𝙤𝙣𝙤𝙢𝙞𝙘𝙨 𝙖𝙣𝙙 𝘼𝙥𝙥𝙡𝙞𝙚𝙙 𝙈𝙖𝙩𝙝𝙨 𝙃𝙖𝙧𝙫𝙖𝙧𝙙 Fiscal redistribution is defined as government policy that involves using taxes or transfers as a means to redistribute funds to citizens. This policy is a costly approach and requires precise instances in order to calculate change.

Image - The Fiscal Times

INTRODUCTION AND COST-BASED EFFICIENCY

Fiscal redistribution is referred to as a policy action that refers to imposing universal and targeted social assistance transfers and achieving income redistribution objectives. Balancing and imposing policy requires precision and understanding of changes in policy action over a specific period of time. Integrating better and better approximations of redistribution in both the United States and global policy (Coady and Le)

INCOME DISTRIBUTION AND EQUITY After years of neglect, economists have begun to question the impact of economic inequality. Fiscal redistribution is a mechanism by which policymakers are able to find solutions that impose globalization and technological change. In countries where growth is minimal but benefits the wealthy at a larger rate, there is obviously a strong case for shifting resources from those at the top and giving the less wealthy better access to education. A more equal distribution of resources provides easier access to programs, allowing poverty-stricken households the ability to reduce inequality (Bourguignon). In developing nations, the story of fiscal redistribution is fundamentally different. Countries have a higher disposable income GINI coefficient but also have a higher market income GINI. Coefficient: this makes it where developing countries would benefit from seeing fiscal distribution, where progressive taxation is seen to increase income equality. In addition to progressive taxation, fiscal redistribution can be achieved through levels of health spending and funding in education, which increase the quality of life. (Bastagli et al.)

PROPOSALS AND MECHANICS

Fiscal redistribution can be implemented through multiple mechanisms, such as progressive taxation, transfers, public services, work-fare programs, and pensions. Fundamentally shifting to a method of progressive taxation, higher-income individuals are to be taxed at a high rate, with the revenue being used to fund public services and direct transfers to lower-income individuals. Transfers that are universally implemented, such as a universal basic income program, and public services such as housing, transportation, and education help reduce inequality. following individuals to work in exchange for government benefits that reduce poverty and provide a safety net. As well as pensions for retirees, increasing those pensions, which redistribute over a person’s life, would be funded through payroll taxes. All of these programs are mechanisms of universal basic income that allow for payments to be made for lower-income households but also for middle-income households that allow higher-income households to have their wealth redistributed.

IMPLEMENTATION OF PROGRESSIVE TAXATION

For effective redistribution, an implementation of a progressive tax system would be preferred in regards to other forms of taxation. A progressive tax involves a tax rate that increases or progresses as taxable income increases. The imposition of higher rates on those with higher incomes through the creation of tax brackets. In 2024, the United States had seven tax brackets, compared to sixteen back in 1985. A progressive tax is a flat percentage for those who make an income. (Kagan) The national implementation of progressive taxation is a net benefit to the unequal structures that plague economies today. Progressive taxation is a relatively popular solution where a majority of nations embrace a higher rate of taxation for individuals who make a large sum of money. Proven to reduce inequality, few governments in low- and middle income countries reduce income inequality, which illustrates an increase in the gross national income. Individuals will be willing to provide more funding for government services, which will decrease tax avoidance.

UNIVERSAL/TARGETED MECHANISMS OF GOVERNMENT TRANSFERS

Universal Basic Income provide all or most individuals in a nation with cash transfers which these proposals are recurring, which is paid directly from government funds. These have massive benefits to those with lower incomes and transfers are made to those communities which creates an increase in financial security. Universal Basic Income provided through programs such as workfare, the randomization of the program which shows there being no significant impact on employment, which these programs allow for an understanding that although earnings shifted, the program costs were not substantive enough to have massive consequences. (Bertrand et al) Universal Basic Income having massive benefits such as a small increase in employment and better well being overall. The benefits of a Universal Basic Income program with account for possible setbacks a universal basic income is seen to be effective. The relatively higher rates of disposable income and general morales, with no change in employment, there is a net incentive for nations to implement a universal basic income program. (Allas et al) Pension programs are becoming under fire due to the Asset owners having challenges due to an unstable economy. Uncertainty is persisting in the global economy which is heightened by massive geopolitical tensions and slow economic growth. The implementation of increased pensions would allow for a safety net. Collaboration with artificial intelligence along with the pension design which provides a long standing transition form a defined benefit to defined contribution which pension schemes having a notable trend in recent decades where there is a desire to have cost be predicted. Thesicnrease in life expectacnya nd shifting contribution by employers becomes in creasingly unpopular and being exemplfieid by developments in multiple countries. (Gao et al)

PROOFS AND REASONING

Policy-makers need effective proposals that require precision in implementing the maximum amount of rates of change for legislation. Mathematics is a subject that has a present impact in our world but no branch of mathematics that provides an understanding of rates of change other than Calculus. Policymakers to be more effective need to implement some form of calculus as a method of providing effective policy making that benefits the most amount of people.

PROGRESSIVE TAXATION

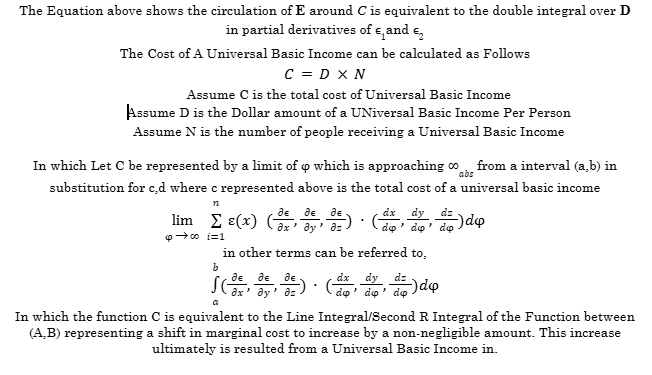

Let T(x) represent the total tax paid by an individual with an income x. A progressive tax function might be structured as

Where T(y) represents the marginal tax rate at income level y. The Marginal T(x) is a function that represents with income x. For example a simple linear model might be:

Where a and b are constant, a represents the base rate, and b determine show quickly the tax rate increases with income. The total tax paid by an individual would them be calculated as:

The effect tax rate E(x), which is the average rate paid by an individual with income x, can be found by dividing the total tax by income:

The function shows that as income x increases, the effective tax rate E(x) increases, illustrating the progressive nature of the tax. The parameters a and b can be adjusted to meet desired policy goals, such as ensuring that the tax burden is more significant on higher-income individuals. This method allows policymakers to design a tax system that is progressively structured, where higher-income earners pay a high percentage of their income in taxes, and the structure can be fine-tuned using calculus to achieve specific redistributive goals.

UNIVERSAL/TARGETED MECHANISMS OF GOVERNMENT TRANSFERS

Not only can this be done with single variable calculus but can also be done with multivariable calculus in relation to the issue of government transfers.

Green’s Theorem below, stating that the line integral around a closed curve C can be converted into a double integral over the region D bounded by C. If we replace the vector field F = (P, Q) with E = (e1,e2) and the differential element ds with d, the theorem adapts as follows:

REFERENCES Coady, David, and Nghia-Piotr Le, “Designing Fiscal Redistribution: The Role of Universal and Targeted Transfers.” IMF Working Papers, no. 105, International Monetary Fund (IMF), June 2020, p. 1. Crossref, doi:10.5089/9781513547046.001.

Bourguignon, Francois. “Redistribution of Income and Reducing Economic Inequality (IMF F&D Magazine). IMF, Finance & Development Magazine, March 2018, https://www.imf.org/en/Publications/fandd/issues/2018/03/bourguignon.

Bastagli, Francesca, et al., “Chapter 4. Fiscal Redistribution in Developing Countries: Overview of Policy Issues and Options in Inequality and Fiscal Policy.” IMF ELibrary, Inequality and Fiscal Policy, 21 Sept. 2015, https://www.elibrary.imf.org/display/book/9781513531625/ch004.xml.

Kagan, Julia. “What Is a Progressive Tax? Advantages and Disadvantages.” Investopedia, Investopedia, 7 June 2024, https://www.investopedia.com/terms/p/progressivetax.asp.

Hoy, Chistopher, and Chiara Bronchi. “Why Does the Progressivity of Taxes Matter?” World Bank Blogs, 9 Nov. 2022, https://blogs.worldbank.org/en/governance/why-does-progressivity-taxes-matter. Bertrand, Marianne, et al. “Do Workfare Programs Live Up to Their Promises? Experimental Evidence from Cote D’Ivoire | NBER.” NBER, NBER, Apr. 2021, https://www.nber.org/papers/w28664. Allas, Tera, et al. “An Experiment to Inform Universal Basic Income | McKinsey.” McKinsey & Company, McKinsey & Company, 15 Sept. 2020, https://www.mckinsey.com/industries/social-sector/our-insights/an-experiment-to-inform-universal-basic-income. Gao, Jessica. “Global Pension Assets Study - 2024 - Thinking Ahead Institute.” Thinking Ahead Institute, 23 Feb. 2024, www.thinkingaheadinstitute.org/research-papers/global-pension-assets-study-2024/. Accessed 12 Aug. 2024.

See More Posts

Copyright © 2021 Govest, Inc. All rights reserved.